Quarterly Crunch Q1 19/20

Posted on October 2019 By Judy Cole

The first quarter of the 19/20 financial year is all wrapped up and Christmas is around the corner. It’s time again for my Quarterly Crunch where we look at how the SAP market and Speller has performed over this last quarter (Q1) the first of our quarters for the 19/20 financial year.

What skill did we place most of? What skill was highly sort after? Is the SAP market hot… or not?

Place your bets because it’s time to find out…

For your own comparison here is my Q4 (FY18/19) Quarterly crunch and here is Q1 for last year (financial year 18/19) just for fun!

You can see all of our Quarterly Crunches on our blog if you wish to look at even more stats… exciting!

To recap, we give you Speller’s actual sales for the quarter. I don’t share my own opinions (or excuses!) or what we believe to be the reasons behind the results. Sometimes, especially in this online age, we hear too many opinions and it’s nice to be able to draw your own. But if you want our opinion then feel free to comment and ask and/or to share your own thoughts.

At Speller, we had a cracker of an end to the financial year, overachieving on our annual sales target but did we start this year off on a good foot?

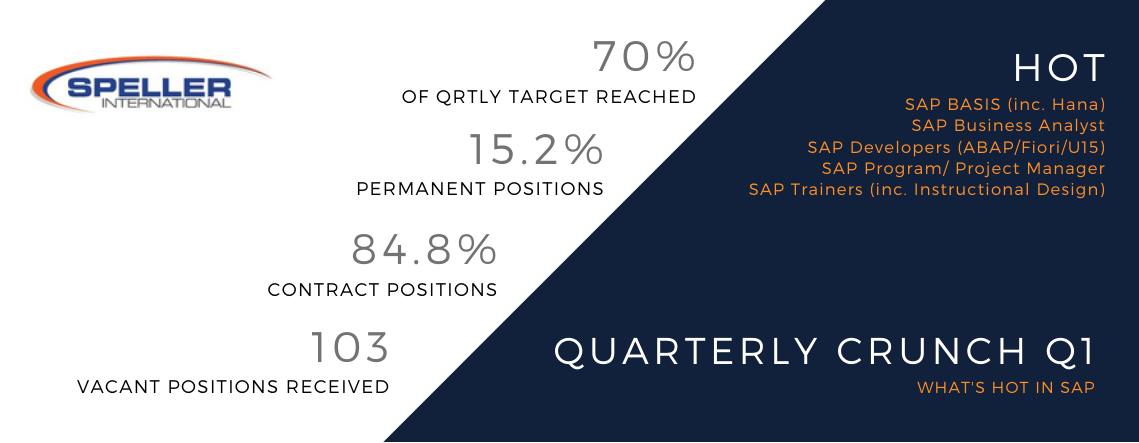

Unfortunately, not! We had a terrible start to the year (well, July was good but August and September results really let us down) which will have us chasing our tail to catch up. We only achieved 70% of our quarter sales target!

In regards to purely sales (sales = people placed within the SAP field in either contract or permanent engagements), Speller International only achieved 70% of quarter sales target! We placed 36% less people in Quarter 1 this year (July/Aug/Sept 2019) than we did in the previous Quarter 4 (April/May/June 2019). By comparison, it was 3% less than the same Quarter the previous year (July/Aug/Sept 2018).

What are the top 5 roles we placed in the Quarter?

SAP Developers (ABAP/Fiori/UI5)

SAP Program/Project Manager

SAP BASIS (inc. Hana)

SAP Business Analysts

SAP Trainers (inc. Instructional Design)

FYI Last quarter (Q4 FY18/19) … It was;

SAP Training & Documentation

SAP Developers (ABAP/Fiori/UI5)

SAP Finance (FICO & S/4)

SAP Data (conversion, analyst & master data)

SAP HCM (SF,HR, PY)

What % were permanent vs Contract in Quarter 1?

15.2% of the people we placed last Quarter were permanent (or fixed term) and 84.8% contract. Note; 12.7% of the people we placed in the previous Quarter (Q4) were permanent.

How else can we measure how busy the market was?

While the number of people we placed is a good indication, it is not always the best indication for us to gauge how the market is/was performing. We also like to look at the number of requirements we received from our clients (requirements = vacant job positions which we are engaged to work).

Let’s look at the number of requirements we received in during the Quarter;

Speller International received a total of 103 vacant SAP job positions to fill throughout the Quarter, compared to the previous Quarter which was 161 vacancies (and 109 in Q1 last year). Those positions were across our 3 divisions (SAP IT, SAP Change and Training and SAP Corporate Services) as well as being across Australia and NZ.

Of those vacant positions we received, 16% were permanent or fixed term engagements and 84% were contract requirements.

Top Requirements

SAP HCM (SF, PY, HR)

SAP Business Analyst

SAP Program/Project Manager

SAP Change Management

SAP SD Consultant

SAP BW/BI (inc Hana)

SAP Finance (FICO & S/4 Consultant

SAP Tester

SAP Developers (ABAP/Fiori/UI5)

SAP Trainer (inc. Instructional Design)

FYI – the top 5 requirements from Q4 were;

SAP HCM (SF, PY, HR)

SAP Training & Documentation

SAP Business Analyst

SAP Developers (ABAP/Fiori/UI5)

SAP Finance (FICO & S/4)

Most difficult skill set to find for Quarter 1 (in no particular order)

SAP SuccessFactors and Payroll (across any role – Functional, BA, Tester, Data, Project Management and Training)

So that was our Quarter 1; our top placed SAP areas, SAP skills most required and permanent vs contract data – all without any conclusion from us!

New Roles/Skills Emerging

This is not an emerging or a new skill but SAP SuccessFactors and SAP Payroll Consultants have been in extremely high demand and will continue to be this quarter.

Average Contract Length

Last Quarter we averaged an initial contract length of 21.52 weeks (this does not take into account extensions), Q4 was 15.75 weeks, Q3 was 18.81 weeks, Q2 was 17 weeks and in Q1 it was 19.5 weeks.

What’s in store for the next Quarter? Stay tuned for the next instalment of our Quarterly Crunch!