The Speller Yearly Review

Posted on August 2019 By Judy Cole

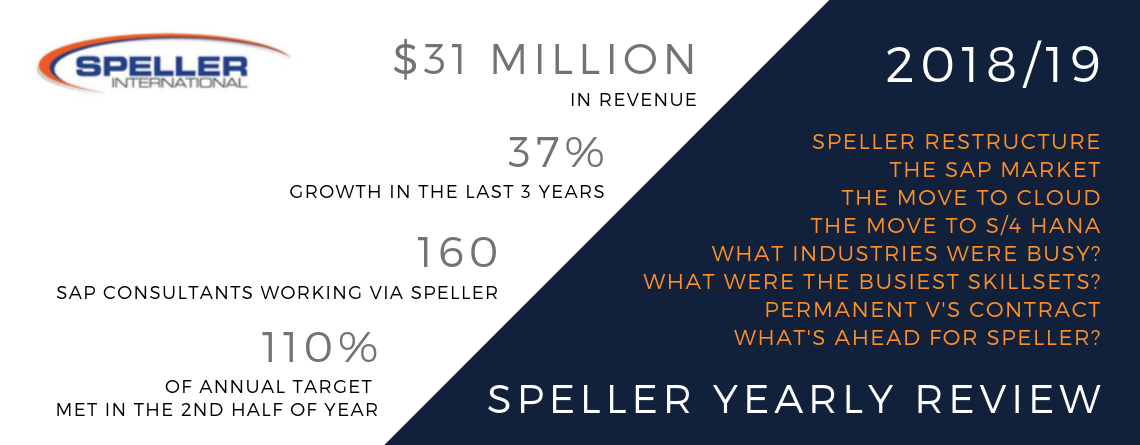

As we settle into the new financial year (19/20) and we prepare for our Speller annual company trip away, we reflect on our busy but challenging past year (18/19).

This year we head up to sunny Airlie Beach to try and escape the winter blues and more importantly, set some goals, plans and focus for this financial year.

For those of you who follow my “Quarterly crunch” you will know that Speller had a “year of 2 halves.” The first 6 months of the year saw us continuously miss sales targets, yet the last 6 months of the year saw us tremendously overachieve, resulting in 110% of our annual sales target for the year.

This year we clocked over $31 million in revenue which was purely gained from contract, permanent, fixed term and consulting services in the Australia/ NZ SAP market. It also marks a 37% growth for Speller in the last 3 years.

The 18/19 financial year also saw us achieve a long awaited goal of ours. 150 SAP Consultants out working via Speller in the market – we reached 160 SAP Consultants! Needless to say, I am very proud of what the team has achieved and cannot thank the SAP community enough in the support and loyalty that they continue to show Speller.

Unlike in the quarterly crunches, I will not refrain from adding my own opinion into this annual update. So, let’s take a look at why I believe we have had a great year but a slow start.

Speller Restructure

I removed myself from a “billable Sales role” in order to focus on team development and company strategy to ensure growth for Speller as a company and growth for our internal Spellerites. We also had 3 x new staff members to train, along with a plan to hire 2 more. We also had a technology overhaul to plan.

The first 6 months of the year saw a lot of change internally and our new team members needed time to get up to speed and start achieving targets. The first 6 months was always going to be difficult. The second half of the year saw the team firing on all cylinders. Everyone was used to the changes and as a result we were able to start hitting those targets!

The SAP Market

We found the SAP market across Australia, especially Victoria, was very “Stop/Start” at the beginning of the year. We had lots of opportunities “about to happen” or go on hold as companies seemed to struggle to plan or get budgets for their SAP projects approved. This all turned around in the second half of the year and lots of projects seemed to drop all at once. At one point we had over 50 SAP SuccessFactors vacant requirements on at one time!

The move to Cloud

We see the move to Cloud products such as SuccessFactors, Ariba, Fieldglass, Concur and C/4Hana as a real challenge for a lot of our customers but not all. There is a miss conception that once a business chooses a Cloud product and Vendor, there is not really much work to do from their side.

This misconception has led to projects dragging out longer than planned, some of which have failed., and all of which ultimately making a sudden and very urgent realisation. That they do in fact need an experienced Project Manager, BA, Test Lead, Data Analyst, Integration specialist and Change and Training resource immediately. We had a lot of that in the second half of the year!

The move to S/4 Hana

As 2025 looms closer, the realisation is starting to set in that this move is an inevitable one. But the challenge of how to do it is at the front of our client’s minds.

The Migration

The Brownfield

The Greenfield

And not just how to do it… but how on earth will you get the budget and make a business case for it?

In the last 6 months we have seen the Australian market start to embrace this move and really put plans in place to make the move. Those plans have ranged from either just doing it or preparing for it. This involves preparing the technical environments, tidying up and updating ECC environments, moving to Cloud Products, doing data projects to clean up data, upskilling their internal staff, preparing for skills shortage and learning new and more Agile ways to do things – all having a wonderfully busy impact on the Australian market.

What industries were we busy in last year?

Speller International worked with a total of 59 different SAP customers/consulting companies last year compared to 48 the year before. This was across many different industries such as FMCG, Retail, Utilities, State and Federal Government, Mining/Mining Services, Manufacturing, Education, Logistics, Construction, Automotive, Services and IT Consulting.

It is fantastic to see that every industry is spending money on IT and the majority of these organisations are investing in large business transformations as opposed to just “keeping the lights on”. Our absolute busiest industry last year was Government (Federal and State) followed by FMCG.

What skillsets were we most busy in?

If you read our Quarterly crunch, this will come as no surprise to you…

SAP Developers (ABAP, Fiori)

SAP Trainers/Instructional Design

SAP HCM (SuccessFactors, Payroll & Hr)

SAP Business Analysts

Project/Program Managers

SAP Finance (FICO & S/4)

SAP Change Management

SAP BASIS /Hana

SAP Integration (PI/PO/HCI and even Mulesoft)

SAP Data (Data Analysts, Migration, Master Data& Architects)

Permanent Vs Contract

We still had a very high amount of contract work. 89% of our placements were contract vs 11% permanent or fixed term. I believe the low permanent placements are due to a few factors which have not really changed from last year;

There is still an uncertainty about the best way to structure IT teams. With continuous projects, more complex landscapes, increased Cloud products, and multiple vendors coupled with supporting a business (with a big appetite for technology and change), finding the perfect structure is proving to be a very difficult task

Organisations are happy to wait for the perfect fit with their permanent hires and they are more inclined to utilise internal HR/recruitment teams to fill these

SAP salary levels have historically been well below the contract rates world

Speller are a more “contractor and SOW” focused company

What’s ahead?

I believe the SAP market will only get busier this year with the company appetite for Change still extremely high and SAP’s S/4 roadmap becoming clearer.

There are some large projects kicking off – Defence, which has been top of the “gos” for the last 3 years – but finally announced IBM as their prime partner. IBM also picked up Kraft/Heinz Asia Pac part of their global project based in Melbourne so they are set for a busy year! We are seeing a gradual increase of “global projects” setting up Asia Pac teams out of Australia – which is good news.

We will continue to see a mixed technology environment where by non-SAP Cloud products are sneaking in to SAP Landscapes such as SalesForce, Workday, Dynamics etc. This is creating more work in Integration, Data and Business related roles where candidates with a “mixed and adaptable” skillset eg BA’s, Project Managers, Change and Training will continue to be extremely busy.

We do not see the need for ABAP/Fiori to dissipate and it still continues to top our most placed list – but from a “softer” skillset perspective. It is important for consultants to continue to try and develop their business engagement and ability to pick up new skillsets whether it be SAP or not.

From a company perspective, be prepared for some major skills shortages in some of these new skillsets. Ensure to account for this in your project planning and budgeting otherwise you may find your projects hits a pretty big hurdle before it even gets going.

How have you found the market? Please feel free to add, comment or disagree with the above. The market is big and continuously evolving and I know my opinion is not always right … J

If you want to know more about how Speller and the SAP market are performing each quarter follow us on LinkedIn for our quarterly updates!